by Aniket Bhushan

Published: April 23, 2016

Canada prides itself on being open to foreign trade. Canada’s trade to GDP ratio is around 63% making it one of the more open economies in the world. Canada accounts for approx. 2.5% of global exports and imports.

Trade is an import element in Canadian development strategy. This is especially the case since the amalgamation of the former autonomous aid agency into the foreign affairs and trade ministry.

Canada provides generous access to developing countries through preferential trade agreements, FTAs and FIPAs, specific market access initiatives and through ‘aid for trade’ (A4T) initiatives.

Some of the most important Canadian initiatives aimed at developing countries include: the General Preferential Tariff (1974, updated in 2014), the Least Developed Country Tariff (LDCT 2003) and Canadian Market Access Initiative for Least Developed Countries (2003), and the Commonwealth Caribbean Countries Tariff (CCCT 1986).

Unilateral import tariff reform and reduction

As discussed in the lead up to the recent budget, there is considerable scope for unilateral tariff reform, reduction and elimination as Canada’s import tariff system is excessively complicated, costs the private sector billions, lowers productivity and does not produce enough government revenue to justify it. These arguments are most effectively put forward by Mike Moffat, who makes a strong case for unilateral tariff elimination, here and here.

Only a handful of products account for the vast majority of import tariffs (or duties) collected by Canada. Because these include the few product areas in which developing countries are competitive in the Canadian import market, we decided to complement the analysis by looking at it from a development perspective.

How much does Canada collect in import duties and tariffs; on what and from who?

Canada collects approx. CAD$4 billion in import duties and tariffs a year. It is worth remembering even though Canada has ‘free trade’ with several countries this does not mean import duty and tariffs collected are necessarily zero. For e.g. Canada has free-trade with the US, despite this the US is the second largest country in terms of import duty collection. However, the rate of collection is very low – import duty accounts for only 0.2% of the total value of goods imported into Canada from the US.

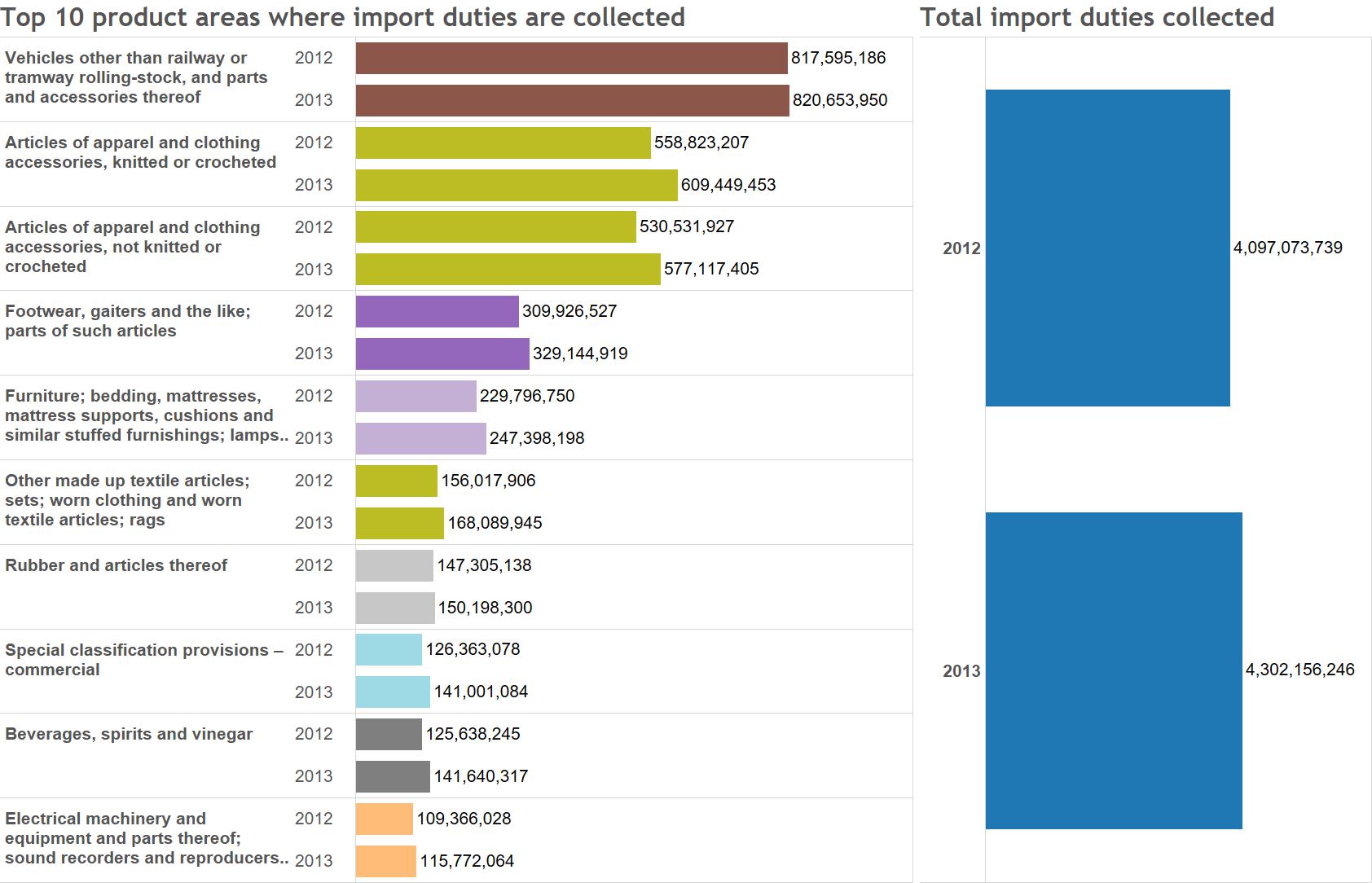

While there are a number of product areas with quite specific tariffs – at least 94 product groups at the HS 2 level, the Customs Tariff schedule is a 1569 page document with well over 15,000 tariff items – only 10 product areas account for the vast majority of tariffs collected. The top 10 product areas, visualized below, account for $6.4 billion out of the approx. $8.4 billion in import tariffs collected in the two years analyzed.

The single biggest individual product area is motor vehicle imports, however, the biggest product area combining closely related groups is apparels, clothing and textiles, accounting for $2.6 billion in tariffs collected (2012 and 2013). Developing countries dominate the Canadian import market for apparels. The other two products where significant import tariffs are collected and where developing countries are competitive are footwear and furniture.

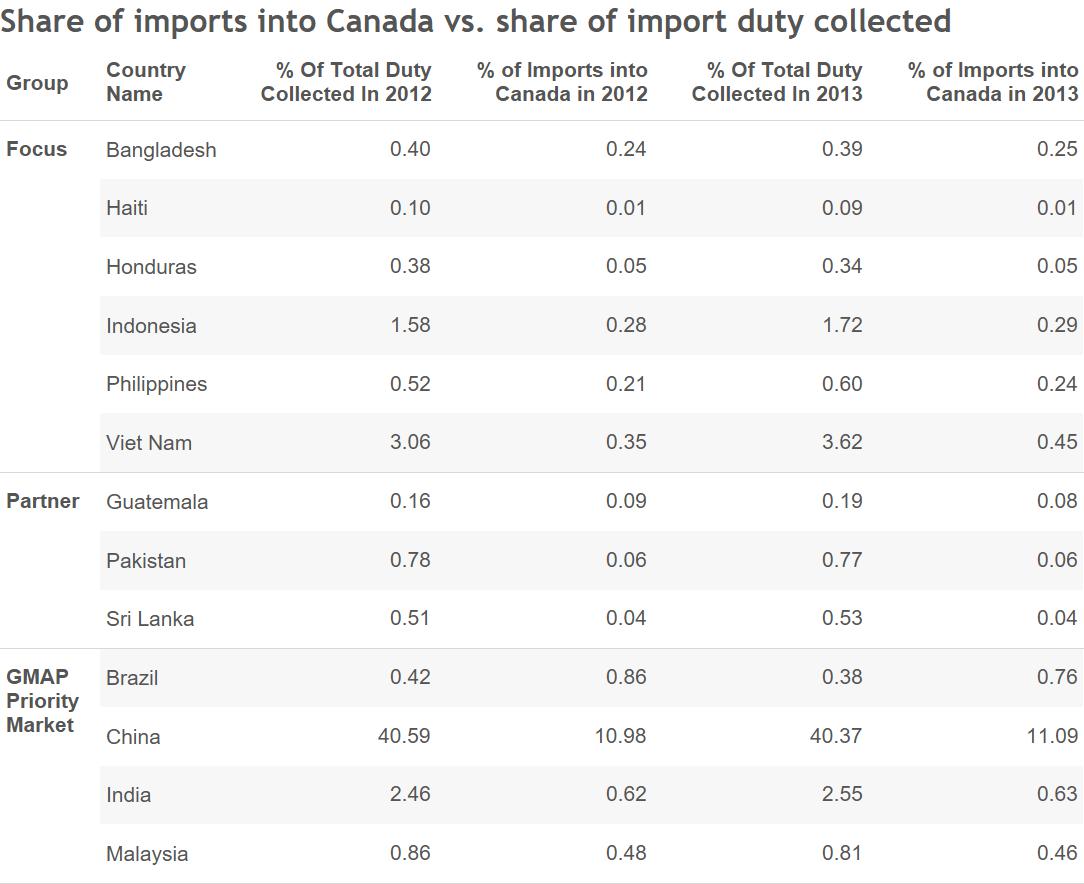

China accounts for the largest share of import duty collection. In fact approx. 41% or $3.4 billion out of $8.4 billion of Canadian import tariffs are collected from China. Other developing countries whose imports contribute significantly to Canada’s import tariffs include: Vietnam, India, Indonesia and Thailand. Some of these, and other development partner and priority countries are analyzed in more detail.

Is policy coherent? Trade, aid, development and tariffs

In order to assess whether policy is coherent or not we need to deepen the analysis. The three data points and key take-aways, below, help to do this.

The 13 developing countries below account for over 52% of import tariffs collected by Canada. They are selected purely for illustration, however, each falls under the category of being a “development focus” or “development partner” country based on Global Affair’s priority countries lists for Canadian aid and development. Or as a “priority market” in the Global Market Action Plan. Even though lists may well change, there is a good chance many of these countries will remain important for Canada.

These are countries where Canada is engaged in supporting development, and or trade and trade-related development agendas.

Key take-away 1: Many priority developing countries are over-represented in duty collection, relative to their share in Canadian imports

The table below compares the share imports from each country into Canada make up as a percentage of total imports into Canada, against the share of duty collected on the imports of each country relative to total duty collected.

Vietnam which accounts for less than half a percent of Canadian imports, accounts for around 3.6% of total duty collected; Indonesia which accounts for around 0.3% of imports, accounts for 1.7% of duty collected; India which accounts for 0.6% of imports, accounts for 2.5% of duty collected; China – the big outlier – accounts for around 11% of imports, but over 40% of duty collected. This is not universal. Brazil for e.g. accounts for a lower share of duty collected than its share of imports.

Key take-away 2: Duty collected as a share of imports are higher in the case of most developing countries than the Canadian average

The figure below computes duty collected as a share of each country’s imports into Canada. This gives us a sense of a real cost of accessing the Canadian market.

On average duty collected accounts for just under 1% of the value of imports into Canada. However in the case of many developing countries, all but Brazil below, the ratio is far higher. In some cases the high ratio will be explained by the low level of imports (i.e. smaller denominator) e.g. Haiti, to a lesser extent Honduras, Pakistan and Sri Lanka. In other cases such as Vietnam, Indonesia, China and India – their imports face duty levels that are 3 to 7 times the average. Duty collected is about 7% of the value of total imports into Canada from Vietnam for instance (for comparison, recall, the ratio is about 0.2% in the case of the US).

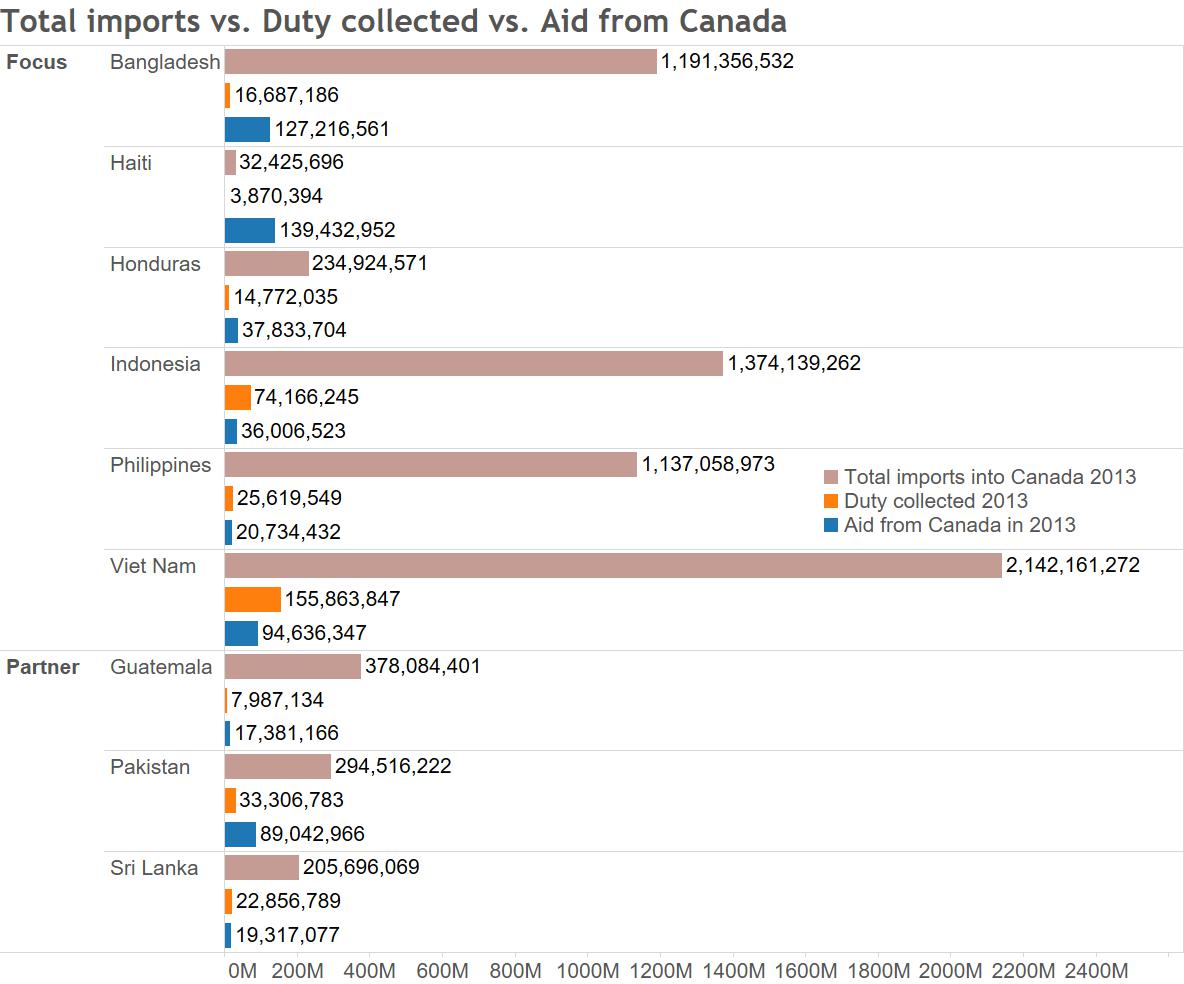

Key take-away 3: In many cases duty collected exceeds or rivals all aid given by Canada to the same countries

Of the 9 development partner and priority countries below, in 4 cases the level of duty collected is higher than all aid disbursed: Vietnam, Indonesia, Philippines and Sri Lanka. In 3 other countries duty collected is significant relative to aid given: Honduras, Guatemala and Pakistan.

In other words, what Canada collects from these countries in the form of tariffs on their imports either exceeds or rivals all the aid we give the same countries.

An even greater irony is that in many cases, including but not limited to Haiti, Honduras, Indonesia, Philippines, Vietnam, Guatemala and Sri Lanka, part of the objective of Canadian aid is to support poverty reduction through trade; the so called aid for trade agenda. According to the OECD, Canada provides Haiti, Vietnam and Indonesia between $10 and $20 million in A4T support a year (higher in previous years).

A reasonable conclusion one can draw from the perspective of pursuing dual trade and development objectives is that policy is not as coherent as it could be.

What criteria for reform and what reform?

The actual costs of import tariffs and duties are likely a lot higher as there are indirect compliance costs that are hard to estimate especially in the case of developing countries.

A simple criteria for reform could be two fold:

Strategic imperative: where the strategic imperative is not strong or clear, tariffs could be candidates for unilateral elimination or other reform. A strategic imperative for example could be negotiating leverage in future trade negotiations. Or specific (allowable) sector protections to safeguard Canadian domestic supply.

Revenue imperative: where the revenue imperative is not strong or clear, tariffs could be candidates for unilateral elimination or other reform. If revenue collection is not significant (which is in most cases given tariffs make up a small share of Canadian revenue) they could be reduced, or eliminated. If the cost of removal is not high they could be candidates for removal. There could be additional savings in the form of reduced costs for the expensive trade tribunal infrastructure that supports (relatively obscure) cases and regulations, and costs the taxpayer about $10 million a year.

Reform options could be placed on a spectrum – from unilateral elimination to partial/phased reduction to creative utilization of funds to support market access and trade capacity development. The other end of the spectrum, which is always an option, is continued incoherence.

Who may gain from reform, how and how much?

Gains from unilateral tariff elimination extend from developing countries, to Canadian business and ultimately to consumers.

Developing countries would gain directly, monetarily, the amount that is otherwise lost to tariffs (all things being equal) if these tariffs are eliminated. For the countries above that would equate over $4 billion per year, driven primarily by China. Gains could also come in other forms such as new opportunities and business linkages.

Many of the product areas where developing countries could gain are very low margin – apparel, footwear, and many segments of furniture. So even small changes could have an impact on final margins, profitability, and partnership opportunities with Canadian firms.

Canadian business (importers) would also gain from lower costs, including lower compliance costs. Selective lowering or cuts could help provide incentive for new partnerships with suppliers.

Ultimately the consumer would gain from lower cost of imports. Mexican beer would be made cheaper, as could mattresses and furniture. It is worth noting that such tariff elimination has been proposed, and practiced, in the past including as a form of economic stimulus.

About the data used in this analysis

The data are for 2012 and 2013 (the latest complete years available). The data were sourced from Statistics Canada (via the University of Toronto) at HS 10 level. They were merged with our trade data system, aggregated up to the HS 2 level, joined with country characteristics and classifications, and other data points such as aid data.

Recent Comments