By Aniket Bhushan

Published: Oct 20, 2020

Risks from deglobalization are greater for Canada than its peers. Building Back Better with a focus on Countering Deglobalization presents opportunities for Canada. This analysis offers 4 policy ideas on migration and remittances:

- Reclaim migration and remittances from a development perspective: GAC has an opportunity to reframe its economic rationale narrative. Building back better will require tying domestic and international priorities more closely. Immigration is the key driver of Canada’s economic prospects and growth in migration relies heavily on development prospects in developing countries and Canada’s support for the same.

- Market Canada as an ideal post-COVID international education and immigration destination: stalled migration poses significant economic risks to Canada. These trends may not be transitory and therefore require a clear strategy to reposition Canada as a post-COVID destination.

- Assess the impact of COVID on new immigrants and specifically study remittance market behavior during COVID: little is known about the impact of COVID on the multibillion-dollar Canadian remittance market. Emerging evidence points to potential resilience. There are several unanswered questions that GAC can take the initiative to address with a follow up to a key survey it commissioned in 2017.

- Incentivize innovation that leverages digital technology in the remittance market: one of the enduring effects of the pandemic is that it has accelerated digital transformation including the in payments space. Despite interest in digital technologies, awareness and use of the same in the Canadian remittance market is extremely limited. Now is the time to bring together the fintech, financial and development sector to incentivize collaboration and innovation in the digitization of overseas remittances.

Immigration Drives Canada’s Economic Prospects in Multiple Ways

Immigration impacts Canada’s domestic economic prospects via 2 key channels and developing countries affect both significantly. The first channel is longer-term and slower. Consider the following:

- Going into COVID19 Canada had the fastest economic growth in the G7

- Canada was also benefiting from the fastest population growth in the G7 (levels not seen since the 1990s)

- Immigration is responsible for 82% of Canada’s population growth, and 100% of labour force growth

- Developing countries are responsible for approx. 80% of all types of migration (higher in some cases like economic migrants and foreign students)

Immigration, Housing and Economic Prospects

The second transmission channel is more immediate, direct, and almost never analyzed from a development perspective. Consider the following:

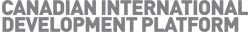

- The single largest industry sector of the Canadian economy (per the NAICS codes) is Real Estate (this was the case going into COVID19 and is even more so now)

- Before the pandemic hit, more than half of Canada’s GDP growth came from real estate sector activity

- Immigration is the most important driver of demand for Canadian real estate at the margin; it is the dominant driver of price trends in the largest cities which trickles down to the rest of the economy

- Over 85% of new Permanent Residents (PRs) come from developing countries

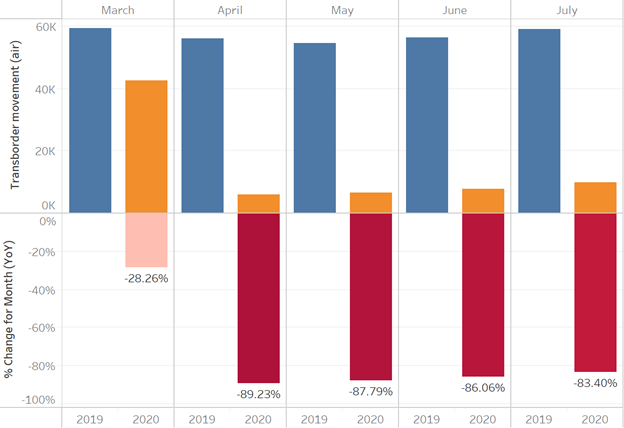

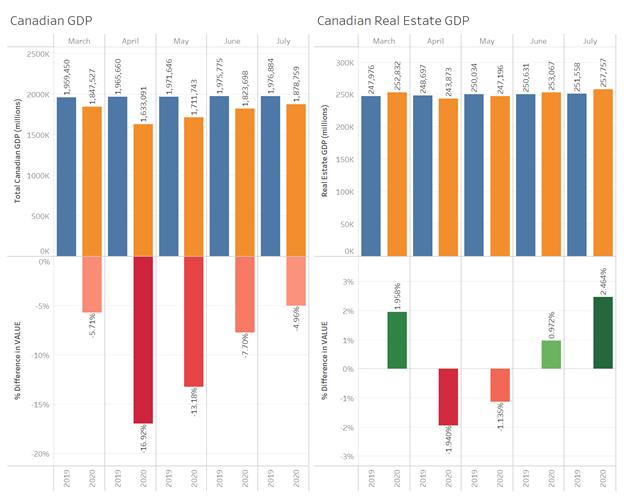

- With transborder air travel still restricted and down over 80%; data indicates new admissions of PRs (down 85% in March) remain down over 60%

- Furthermore, Royal Bank of Canada finds new PR applications are down 80% and recovery could be slower than expected

Temporary Migration and Economic Prospects

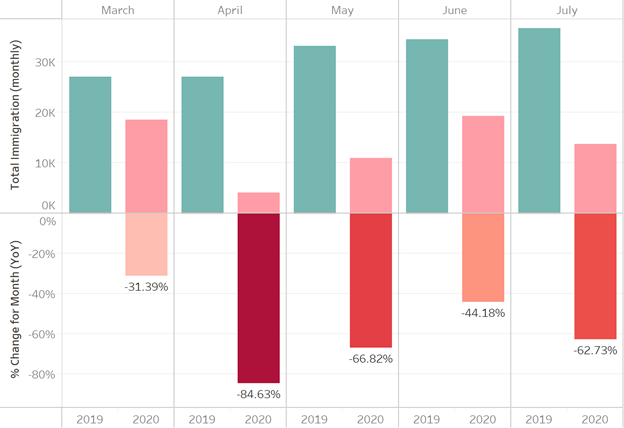

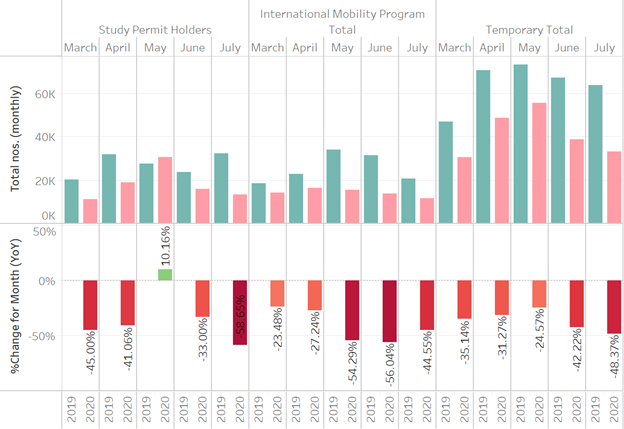

A significant and immediate channel of impact via temporary migration is international student migration. Consider the following:

- Foreign students in recent years have been the fastest growing category of temporary migration to Canada

- 84% of international students come from developing countries

- International students are a key source of revenue for Canadian universities. Tuition revenue contributed by international students from developing countries rivals, in many cases, exceeds total Canadian foreign aid to developing countries

- International student fees (approx. 4-5x domestic fees) contribute 40% of all fee revenue earned by Canadian universities

- With study permits still down approx. 60%, the projected loss of tuition revenue for 2020/21 for Canadian universities could be as high as $3.4 billion or 7.5% of revenue

For GAC, building back better implies making the links between its international and domestic priorities clearer and more tangible. GAC has an opportunity to reframe it economic rationale narrative by seizing the facts that link Canada’s domestic economic prospects with migration. Growth in migration to Canada is increasingly reliant on developmental outcomes and prospects in developing countries. The links to Canada’s growth prospects (especially via housing and labour market demand) are direct and clear, and downside risks from stalled migration are far more significant for Canada than its G7 peers.

Remittance Market Dynamics During COVID

Remittances far exceed foreign aid flows. However, details regarding the dynamics underpinning the Canadian remittance market, until recently, were not well understood. GAC’s initiative in commissioning StatsCan to implement a landmark survey, the Study on International Money Transfers (SIMT), helped fill some gaps. However key shortcoming remain as (to our knowledge) the survey is not longitudinal.

There is emerging evidence that COVID has had an impact on remittance market behaviour, including in Canada.

According to the IMF, unexpected resilience has been observed in some cases. Contrary to initial predictions of sharp immediate declines remittance flows have proven resilient e.g. in Bangladesh, El Salvador, Pakistan, Kenya. These trends point to the potential countercyclical nature of remittances during crises.

However, more nuance is needed. These trends could be easily upended if crisis effects persist or worsen. They may also point to migrant workers facing greater insecurity (i.e. taking on precarious, high-risk, or low standard work, to support themselves and families overseas).

Need to study Canadian remittance market behaviour during COVID

There is some evidence of resilience and countercyclicality in Canadian corridors. For e.g. in the case of one of largest corridors, Canada-Philippines, monthly data shows a substantial drop-off March-May 2020 compared to 2019, however data for June-July indicates a reversal. Moreover, every subsequent month since the April lows has indicated an increase in outbound remittances from Canada to Philippines.

Key unaddressed questions remain, e.g. regarding the potential impact of the emergency response benefit (CERB), wage subsidy (CEWS), and business supports (CEBA), on overseas remittance behavior. Given the demographic overlap between new immigration, COVID related unemployment, CERB and other benefit receipts, these questions are worth closer examination. There is anecdotal evidence of the use of housing leverage (home equity) to support overseas transfers.

Given the likelihood that a not insignificant share of outbound remittances from Canada during COVID have gone to developing countries where domestic fiscal responses relative to Canada have been constrained, it is possible that Canada’s domestic response has had the net effect of stimulating remittances. These questions need more attention and GAC could take the lead.

Building Back Better: On Migration and Remittances What can Canada do

1. Reclaim migration and remittances from a development perspective

Migration has received little attention at GAC from an international development perspective. Remittances have received some attention, primarily under the auspices of financing for development and financial inclusion debates, as part of Canada’s G20 and SDG commitments on reducing remittance prices. But policy interest has been inconsistent at best. Building back better will require tying domestic and international priorities more closely. Revisiting migration and remittances from a development perspective offers the potential to make such links. Policymakers and development advocates should seize the facts and reframe the economic narrative. Immigration is the key driver of Canada’s economic prospects. Growth in migration to Canada relies heavily on development prospects and outcomes in developing countries and Canada’s support for the same.

2. Reposition and market Canada as the ideal post-COVID destination

COVID restrictions have stalled both temporary and permanent migration to Canada. Immediate risks for e.g. loss of revenue for Canadian universities, impact on marginal housing demand and home prices, could be far greater than estimates suggest. Moreover, there is emerging evidence of longer-term effects, e.g. stemming from a slowdown in new applications. These trends may not be transitory and require a clear strategy to reposition Canada as an ideal post-COVID destination.

3. Study Canadian remittance market behaviour during COVID

GAC showed initiative by commissioning StatsCan’s landmark SIMT survey few year ago, this was the first comprehensive survey of the Canadian remittance market. GAC should commission a follow up, specifically aimed at unpacking remittance market dynamics during COVID. There is emerging evidence of resilience in the case of certain remittance corridors. The relationship between coincident factors, such as emergency response benefits, increase in household leverage etc., and remittance dynamics during COVID, requires deeper investigation.

4. Leverage digital technology to maximize the countercyclical potential of remittances

The pandemic has accelerated digital transformation including the in payments space. The 2018 SIMT survey clearly showed that despite interest in digital technologies, awareness and use of the same in the Canadian remittance market is extremely limited. GAC can play an important catalytic role in incentivizing collaboration across the financial, fintech and development sector to support innovation in the digitization of overseas remittances. At a minimum GAC can do more to help increase awareness of digital technology in the remittance space. Other countries have experimented with tax incentives to offset fees, cash-back schemes, and other measures to increase competition, which GAC could study.

Canada’s GDP growth is increasingly driven by the Real Estate sector, which in turn is driven by Immigration: Total Canadian GDP and Real Estate GDP (basic prices, by NAICS industry, monthly). Source: StatsCan Table 36-10-0434-01 (formerly CANSIM 379-0031)

Monthly Admissions of Permanent Residents (total across Canada). Source: Permanent Residents – Monthly IRCC Updates

Monthly admissions of Temporary Migrants (across Canada). Source: Permanent Residents – Monthly IRCC Updates

Transborder movement to and from Canada (by air). Source: StatsCan 23-10-0008-01 (formerly CANSIM 401-0013)

Recent Comments