by Aniket Bhushan and Lance Hadley

Published: June 8, 2020

COVID-19 has had widespread impacts in terms of slowdowns and a dramatic halt in activities across a range of sectors. One area that has not received much attention is the impact on new development projects and the pace of government contracting.

This analysis aims to quantify the slowdown in international development project starts and GAC contracting.

Main findings:

- March is typically a key month for development project commitments and wider GAC contracting, given it is the last month of the fiscal year.

- March 2020 may have represented an over 90% slowdown in new GAC development project starts by budget value.

- The last fiscal quarter, Jan-Mar 2020, represented between a third to a quarter of the typical number of new development project starts in the last quarter since 2015.

- In terms of wider GAC contracting (beyond development), March 2020 may have represented a slowdown of half by volume and a third by value, compared to any other March since 2015.

So long, March madness

An interesting feature of COVID-19’s impact in Canada is timing. March is the most active month from the perspective of GAC’s new development spending contracts. In a typical year about six times as many development spending contracts are signed in March as compared to any other month in the calendar. This is because March is the last month of the fiscal cycle.

From this perspective, COVID-19 hit Canada at just about the worst time. Slowdowns and complete lockdowns began in March across Canada. What has been the impact on new project starts and wider contracting?

Project starts and contracting fell off a cliff in March 2020

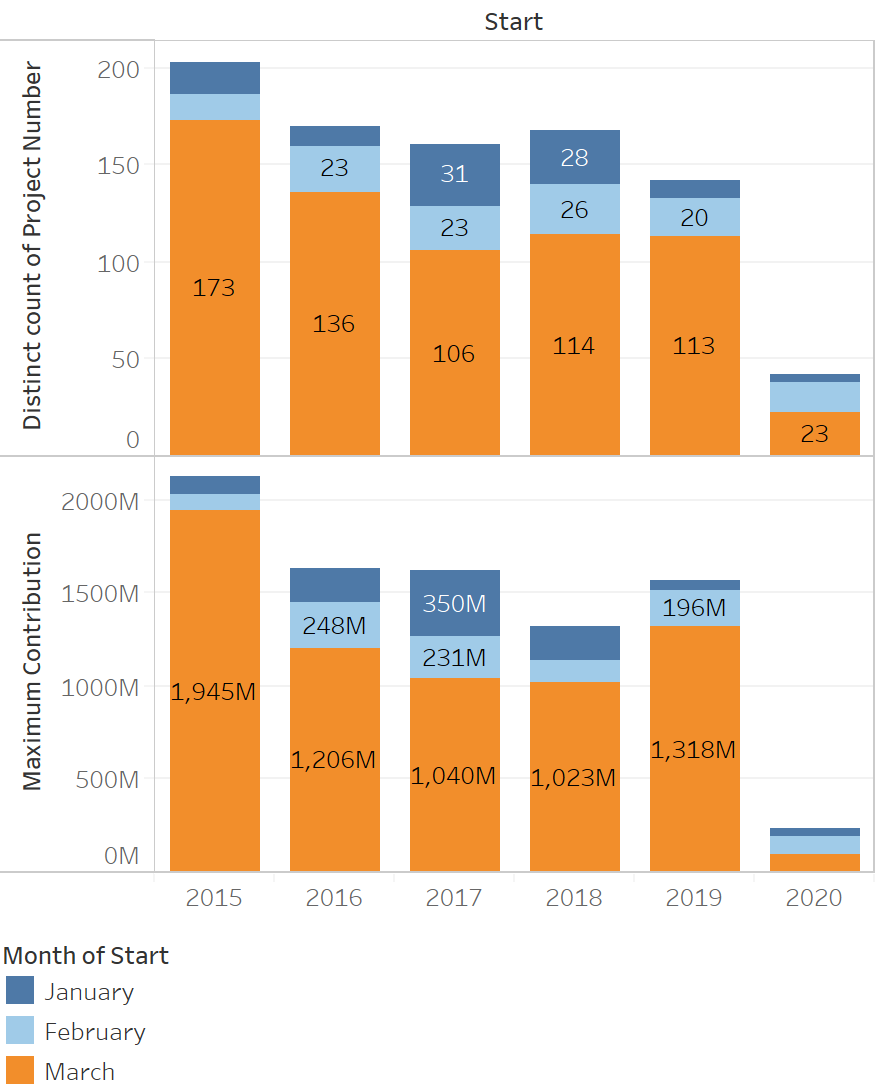

Data analyzed below are as of May 6, 2020. The first two graphs represent new GAC project starts, both as count and by budget value. Typically, the last fiscal and first calendar quarter (Jan-Mar) is the most active in terms of new project starts, driven by fiscal year end in March.

Since 2015 the last fiscal quarter has accounted for approximately 150 to 200 new project starts representing a total budget value of CAD$1.5 billion to over CAD$2 billion. The quarter Jan-March 2020 accounted for only 42 new starts representing less than CAD$240 million in total budget value. The month of March represents an average budget value of approx. CAD$1.3 billion. New starts in March 2020 represented less than CAD$100 million. By project value March 2020 represented an over 90% slowdown compared to the average value of starts since 2015.

New development project starts: GAC project browser dataset (distinct count and value, by project number)

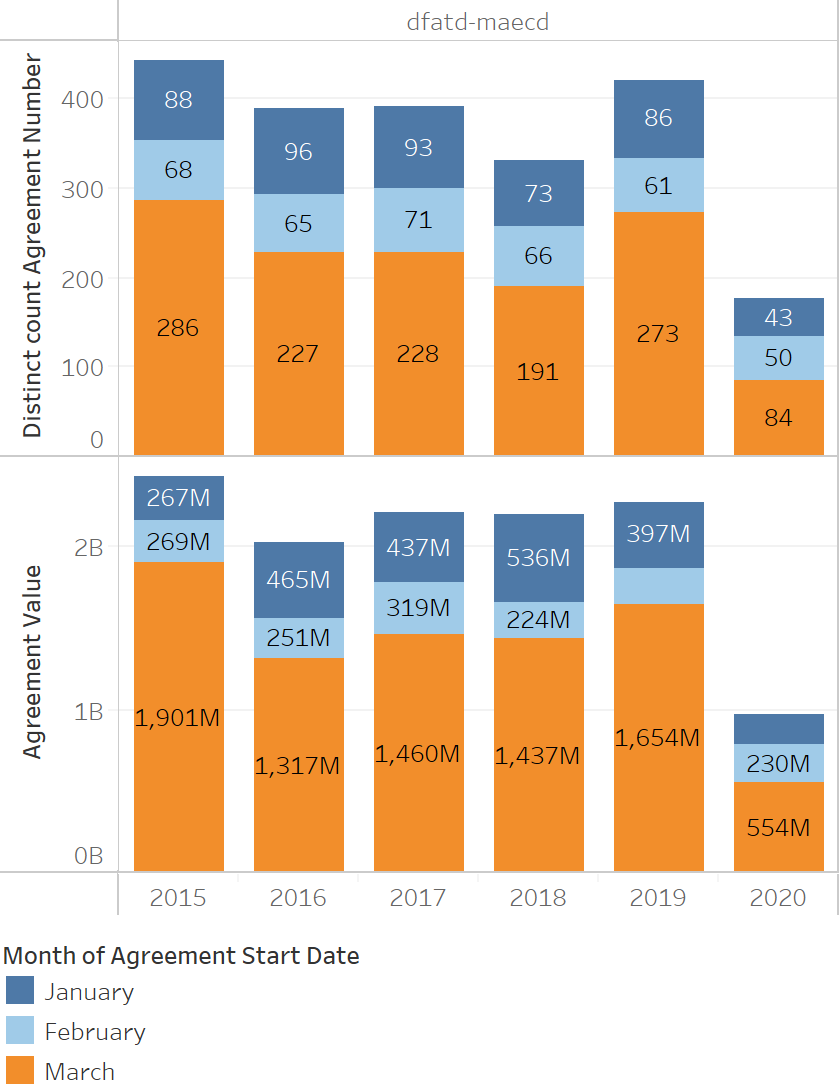

Since the data could be affected by reporting lags and other administrative issues given COVID-19, we checked the wider Treasury Board (TBS) proactive disclosures data which covers a larger universe of major GAC contracting (still labeled ‘DFATD’) over CAD$25k. The trends are further corroborated by TBS open data.

Typically, March accounts for 200 to 300 new agreements representing contract amounts from CAD$1.5 billion to CAD$2 billion. March 2020 accounted for less than half by volume at 84 and a third by value at approx. CAD$550 million.

Overall pace of contracting: Agreements (over CAD$25k) Treasury Board Canada disclosure dataset (distinct count and value, by agreement number)

The data presented in this analysis indicate that COVID-19 has already had a significant impact on new project starts and GAC contracting. It remains to be seen how sustained this impact will be. Visibility regrading forward plans is limited in the absence of a Budget (and outdated, i.e. pre-COVID, Departmental Plans and Main Estimates). The lack of visibility has consequences in terms of limiting oversight and accountability, estimating IAE budget room, shifts in funding across sectors and programs, and availability of emergency response funds (e.g. crisis pool balance).

For additional analyses see our series on COVID-19’s effects on economic growth, trade, investment, and remittances, and poverty reduction.

Recent Comments