by Aniket Bhushan and Lance Hadley

Published: July 14, 2020

The aim of this analysis is to unpack and update our past work on climate-related development finance (CRDF). First, we outline the broad contours of the CRDF space. Second, we analyze Canada’s CRDF portfolio in greater depth, focusing on two key areas: the increasing use of debt instruments; and the overlap between gender and climate. We conclude with questions for further clarification that are relevant both for the ongoing climate finance consultations and Canada’s climate finance strategy going forward.

Climate-related development finance: basics

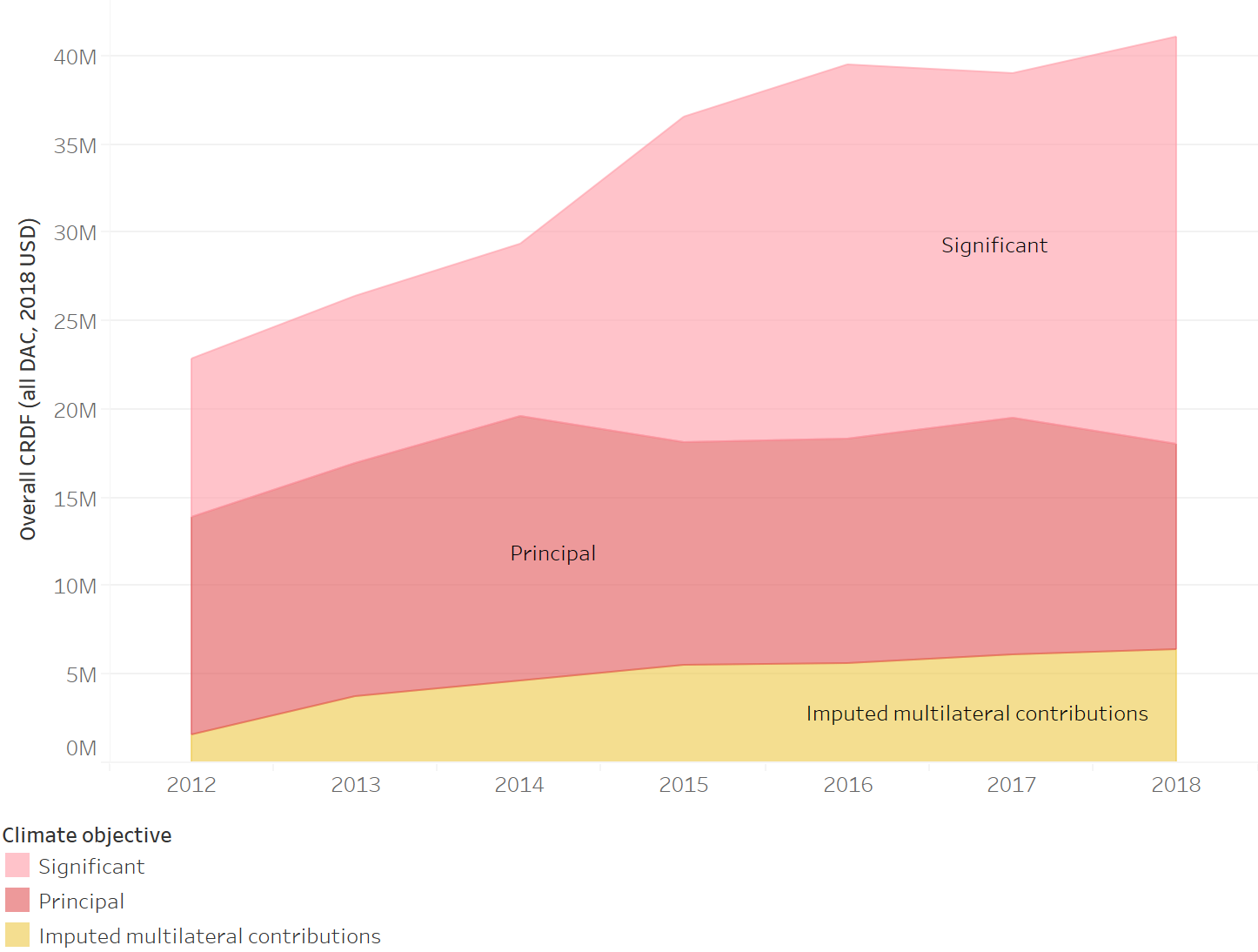

In 2018, the total value of CRDF from OECD-DAC bilateral donors stood at approx. $41 billion. Donor provision of CRDF has grown from approx. $23 billion in 2012. These data are from a bilateral provider perspective, i.e. they do not include additional inputs or leverage provided by multilateral DFIs of their own accord.

Nevertheless, imputed multilateral contributions, i.e. the share of bilateral donor inputs to general multilateral financing that is verified to be climate related, makes up a significant proportion of CRDF, at $6.4 billion in 2018. The share of financing that is coded as climate-principal, i.e. having climate as the main objective, was $11.6 billion in 2018, or half that of the share that is coded as climate-significant ($23 billion).

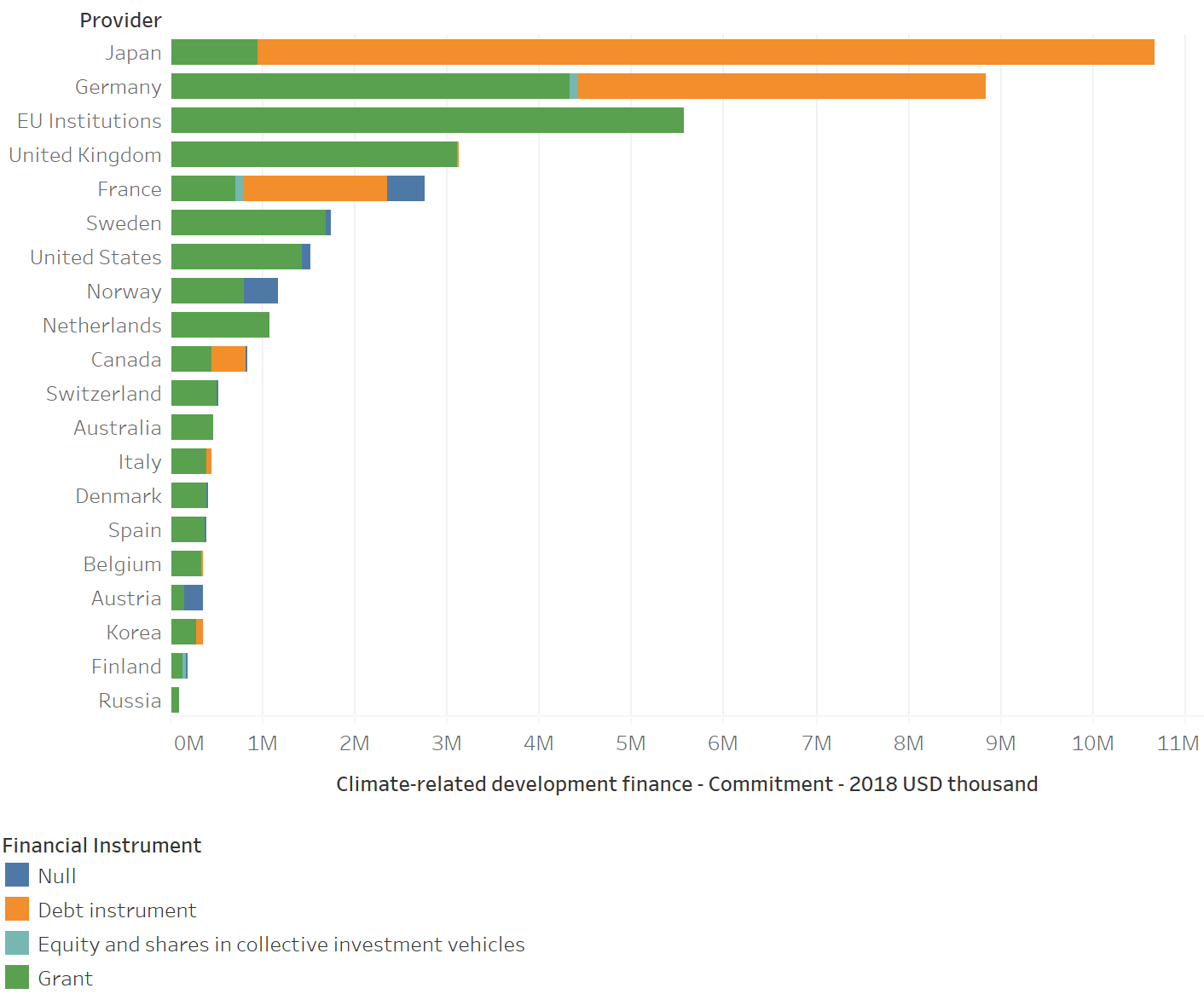

Japan, Germany, EU, France, UK, and the US make up the bulk of bilateral donor CRDF. Canada ranks 10th.

Approximately 50% of the DAC’s CRDF is provided in the form of grants. About 45% is in the form of debt-instruments. The remainder is not coded by instrument type, and a small amount is in the form of equity and debt relief.

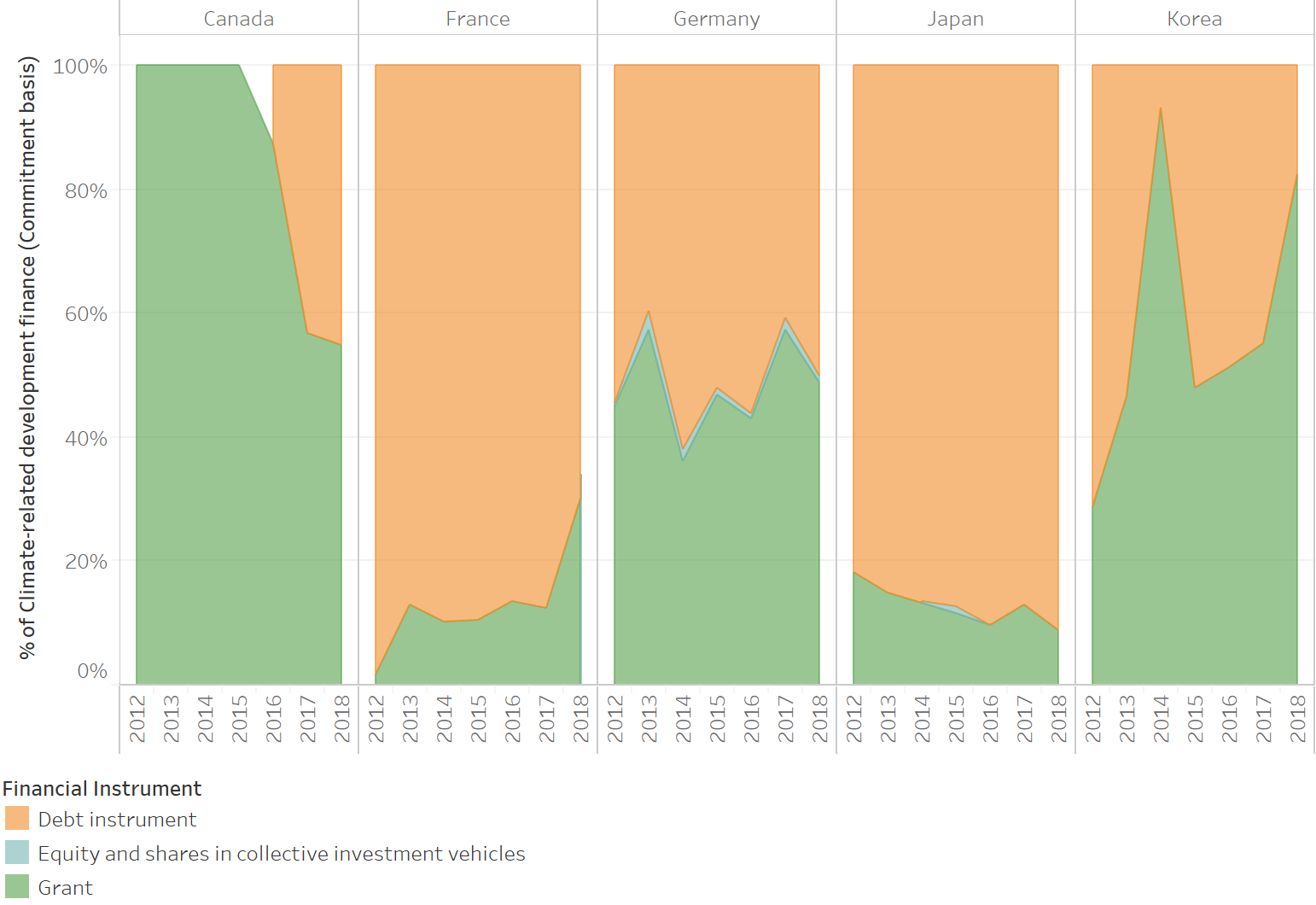

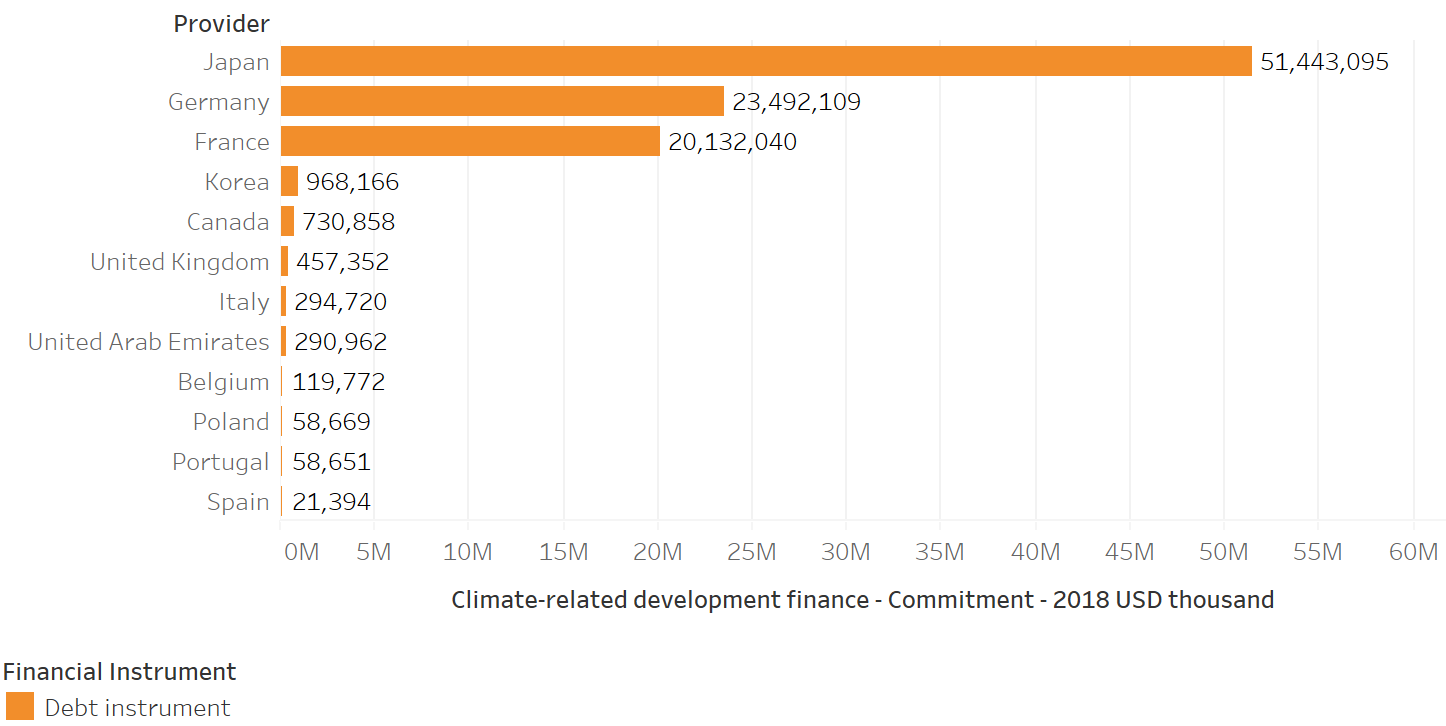

Japan, Germany, and France are by far the largest users of debt-instruments. Each provided between $20 billion and $50 billion in debt financing from 2012 to 2018 (no other donor has even provided $1 billion over the same period). Canada has (very recently) emerged as a significant user of debt-instruments. However, as we discuss below, there are significant differences between Canada’s approach to debt-based CRDF and that of other major DAC donors.

Canada’s climate related development finance portfolio: deeper dive

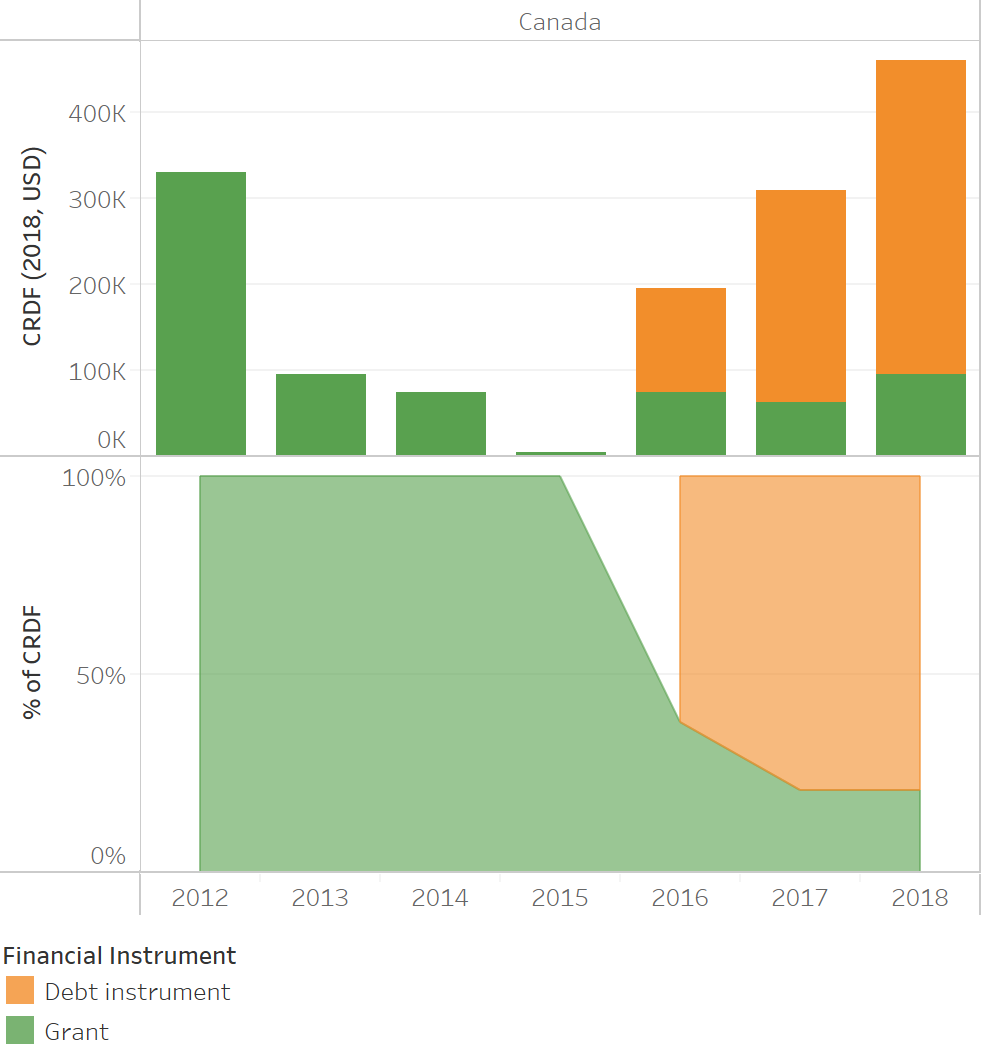

Canada’s climate finance portfolio has undergone major shifts in recent years. We highlight a change from exclusively grant-based CRDF to increasing use of debt instruments. This shift coincides with the Trudeau government’s CAD$2.65 billion climate finance commitment made in the lead up to COP21.

We compare Canada’s approach to debt-based CRDF with that of other major donors in this space. Given Canada’s Feminist International Assistance Policy (FIAP), the overlap between gender and climate is a key consideration. We question the coherence of the current approach, given the limited overlap between gender and climate focused investments.

Canada’s increasing use of debt instruments is curious

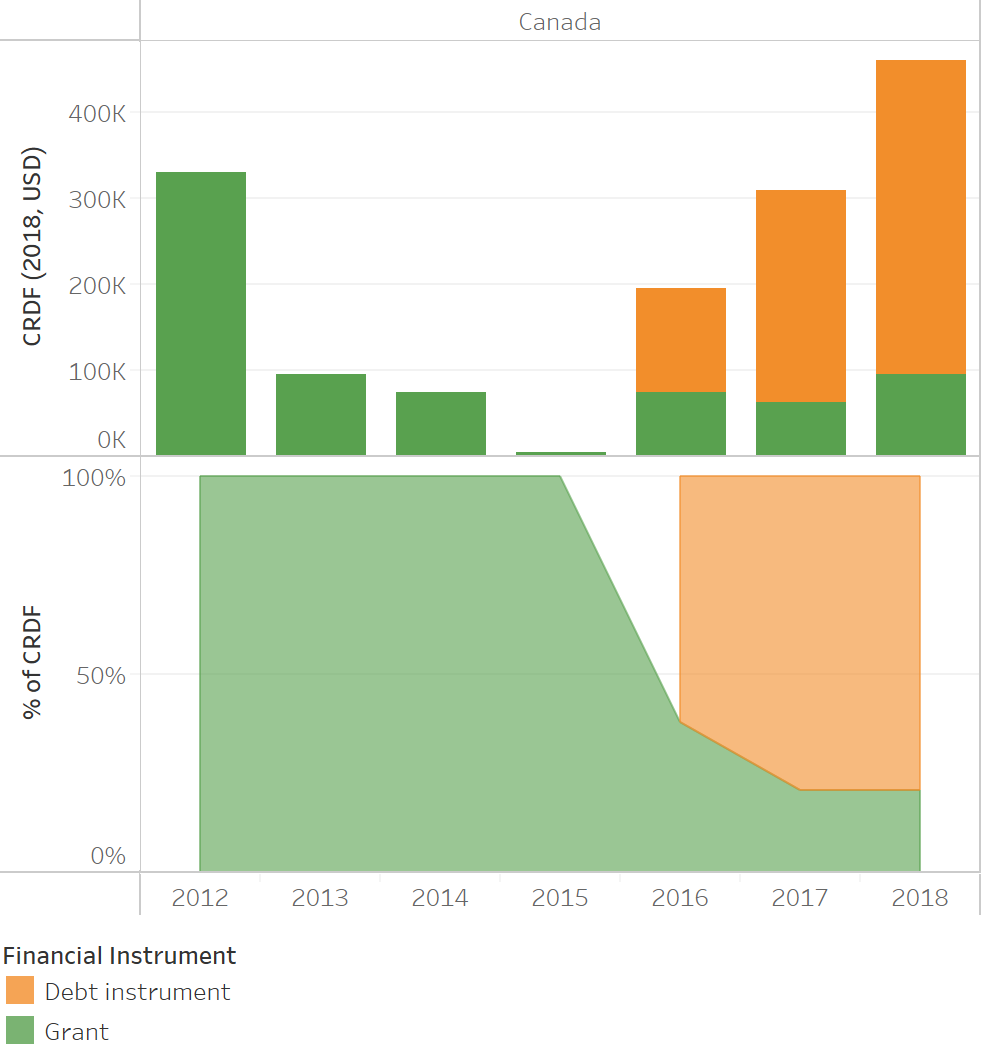

Under the Trudeau government’s climate finance commitment (CAD$2.65 billion 2015-20), Canada’s CRDF portfolio has changed significantly. Prior to this Canadian financing was entirely grant-based. It is now increasingly debt or loan-based.

This trend contrasts with that of the overall CRDF space. Most donors have shifted away from loans to grants, especially as it related to climate-specific or ‘principal’ investments.

When it comes to principal-level climate investments, DAC donors have shifted away from debt instruments in favor of grants. From 2012 to 2014 grants made up 25% to 35% of principal level CRDF. By 2018, grants made up 58% of principal-level CRDF.

Canada’s climate finance trend contrasts that of the DAC. From 2012 to 2015 Canada’s principal-level CRDF was exclusively grants. Since 2016, debt-based financing has dominated Canada’s principal-level CRDF. In 2018, grants made up only 20% of Canada’s principal-level CRDF. Debt instruments, exclusively with multilateral DFIs and regional development banks, accounted for 80% of Canada’s principal-level CRDF.

Canada vs. major debt-based climate finance providers: Key differences

Canada’s use of debt instruments differs markedly from other major donors. The main players in the debt-based CRDF space are Japan, Germany, France, and Korea. Canada’s use of debt instruments is very recent and much smaller compared to these other players.

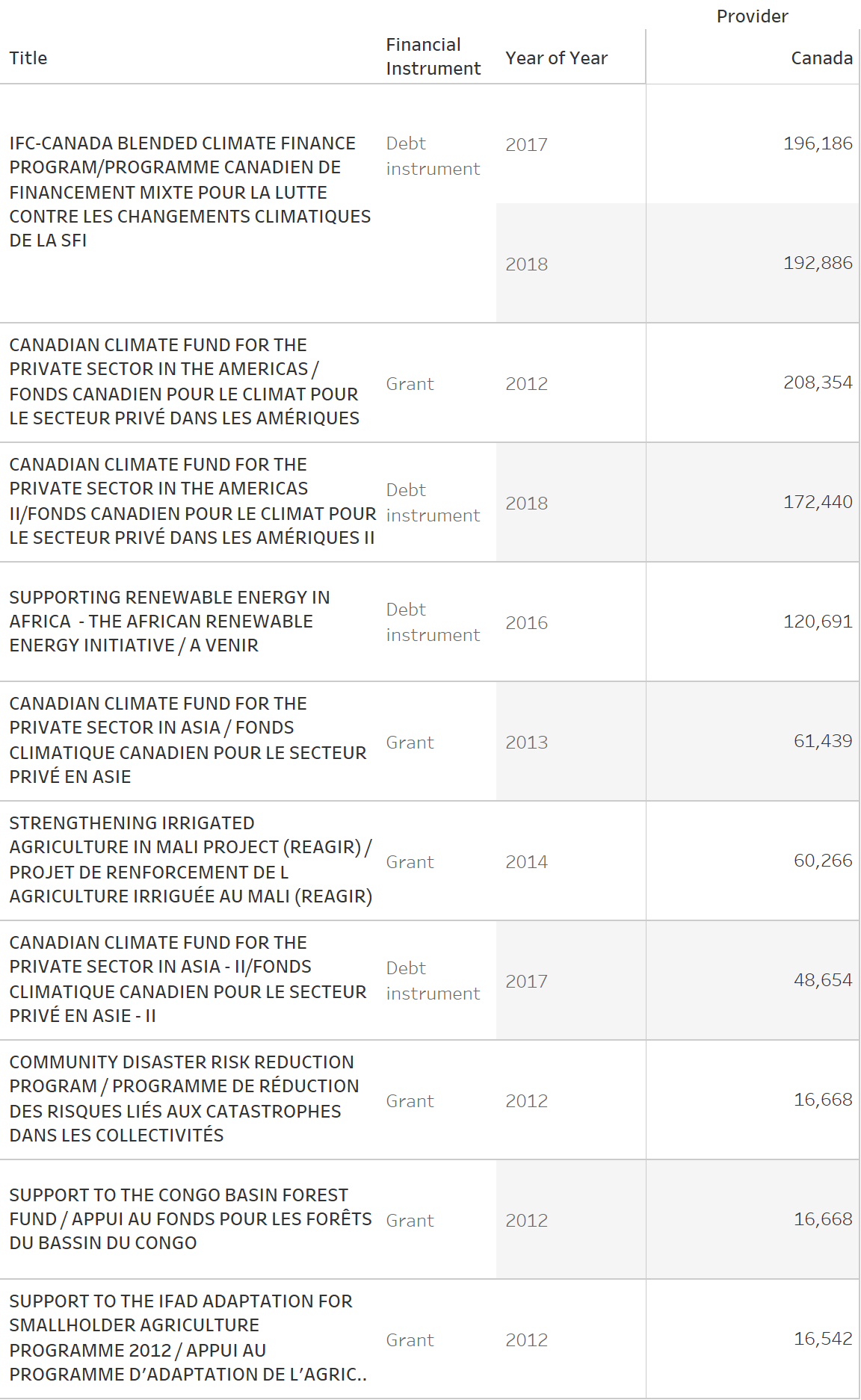

Canada’s debt-based CRDF goes exclusively to multilateral partners – not to recipient governments in developing countries, nor public and private institutions in developing countries directly. Canada’s contribution is fund-managed by multilateral institutions that may co-invest or raise funding from other donors and partners to ultimately (co)finance climate projects in developing countries. This means Canada’s contribution is heavily intermediated. Such intermediation comes with management, scale, risk mitigation, and other advantages, but it also comes at a cost, i.e. multilaterals like the International Finance Corp. (IFC), Asian (ADB) and Inter-American Development Bank (IADB) manage funds on behalf of Canada for a not-always-transparent and not insignificant fee. Eventual projects are either relatively small, or, Canada’s share of larger investments is typically small.

By contrast, other major players in the debt-based CRDF space are more direct. The majority of debt financing goes directly to developing country governments (central and regional), or to public and private institutions in developing countries that undertake climate projects. The chain between provision of debt financing from the donor to actual climate projects, and therefore development impact, is shorter. Projects are much larger. And donor investment makes up a much larger share of the projects they invest in. As a result, attribution of development impacts and outcomes (as well as associated risks) to donor investment is clearer and more direct.

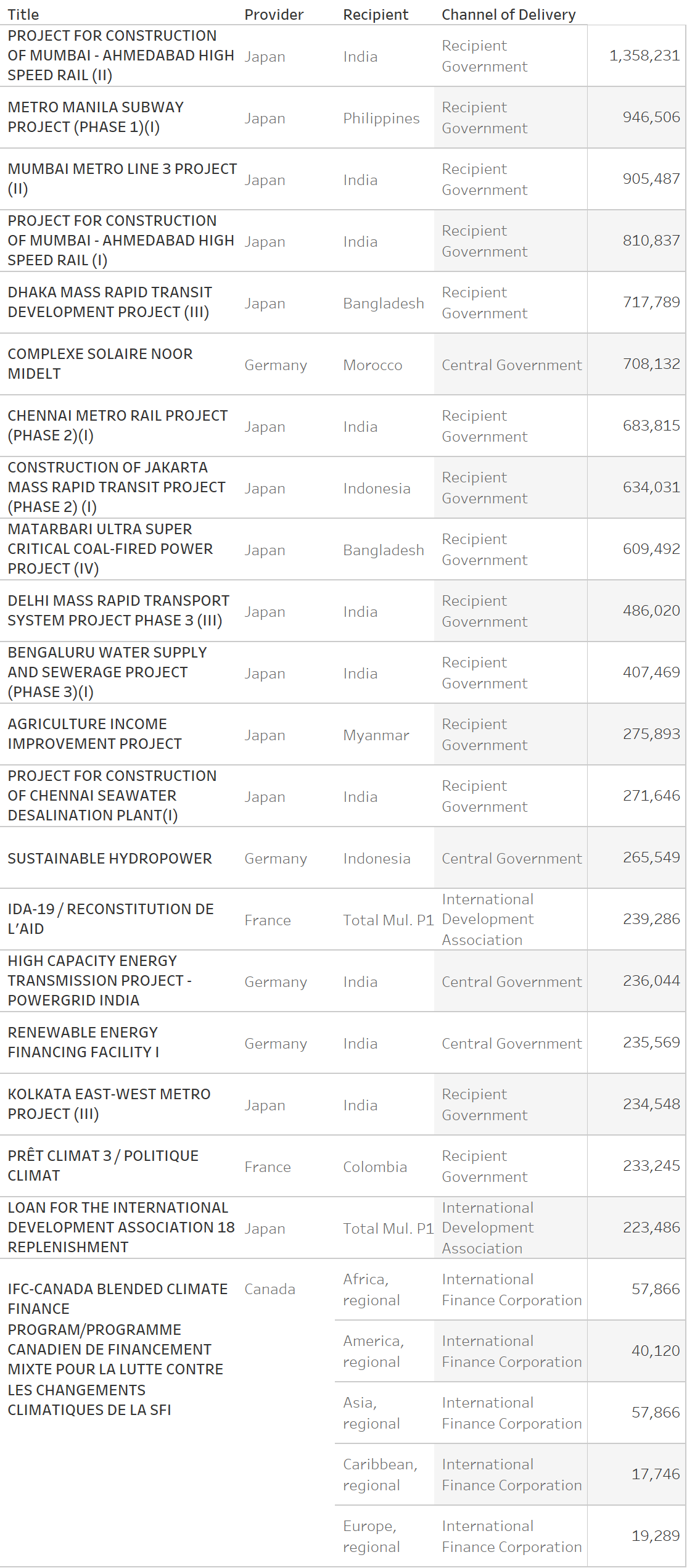

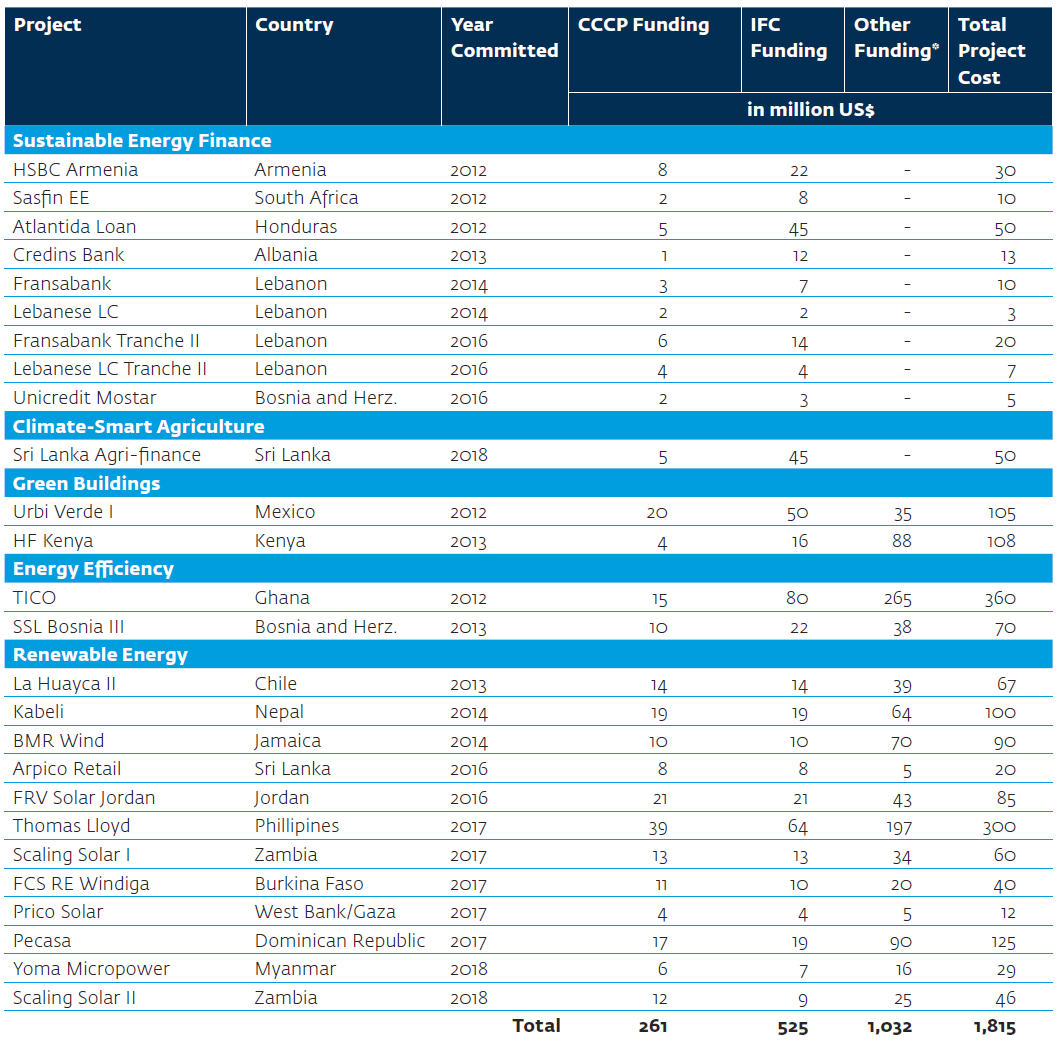

For reference, the largest debt-based CRDF projects in 2018 were undertaken by Japan, Germany, and France. The ticket size of the largest individual investments is routinely in the $500mn to over $1bn range. Recipient counterparts are typically middle-income developing country governments (e.g. central and regional authorities in India, Philippines, Bangladesh, Morocco, Indonesia). By way of contrast, Canada’s largest debt-based CRDF investment in 2018 was an IFC blended finance program which builds on similar past investments that have been ongoing since 2011. Reporting on the investment portfolio of the IFC-Canada CCP as of June 2019 indicates Canada’s share of the program’s onward investments was less than 15%. The share attributed to Canada of the largest recent individual investment was $39mn or 13% of total project cost (i.e. a fractional share of a small, 70MW biomass project in the Philippines).

Another key difference between Canada and other donors is the type of projects that receive debt financing. For major donors, debt financing supports large-scale infrastructure projects (see table below). The largest projects are in the transportation and infrastructure sectors (high-speed rail links, underground metros and rapid transit, procurement of electric public transport aimed at reducing pollution and urban congestion, road infrastructure, power plants, large renewable energy generation, power transmission, and grid upgrades). Typically, such projects have significant scope for the involvement of donor-based private sector companies. Japanese, German, French, and Korean infrastructure majors are typically heavily involved in donor-funded projects in developing countries.

By contrast, Canada’s financing is channeled almost exclusively via the IFC, or the Asian and Inter-American Development Bank. Financing goes towards similar sub-sectors; however, it is split across several smaller projects in more niche areas like renewable financing, energy efficiency, smart agriculture, and advisory services. Scope for Canadian private sector involvement in such projects is negligible or non-existent.

The level of transparency and detail regarding Canadian funds at multilaterals varies, however we can make a few general observations:

Canadian inputs into funds, while clearly marked as debt or ODA-able loans, are almost grant like i.e. Canadian financing is parked within trust funds and remains there to support onward concessional financing. Repayments or other re-flows, if any, may accrue back into the funds.

While Canadian inputs may be nearly grant like, on-lending/investments by the funds are typically in the form of concessional loans (senior loans, subordinate loans, non-equity risk participation, and in select cases like IFC indirect exposure via private equity and quasi-equity). In this sense Canadian inputs support debt instruments indirectly. The aim of these funds is to provide concessional financing to projects that otherwise would not proceed on a purely commercial basis.

In most cases, e.g. ADB and IADB, Canadian finance supports non-sovereign projects or projects that are not backed by sovereign guarantees. Financing is not provided stand-alone, i.e. participation of the multilateral is necessary. In most cases Canadian financing makes up a smaller share than others involved, it almost never exceeds 50% of individual projects.

While these funds are labeled “Canadian” in all cases and coded as ‘bilateral’ by official datasets, this seems to be a misnomer or an exaggeration.

The Canadian Climate Fund for the Private Sector 2 at the ADB provides a good reference. In this case ADB as the trustee of the fund is not only responsible for “origination, processing, and monitoring of transactions” but also the selection and approval of projects. ADB participation is necessary in all transactions, and the portfolio comprises only non-sovereign small projects.

Canada’s approach is very unique. These characteristics are not paralleled by any other major climate finance donor. Which makes it even more important to unpack the overall impact and efficacy of the approach. However, on this front, available data and reporting (primarily from multilateral and not Canadian sources) do not provide a complete enough picture from which to deduce impacts or the share of results that can be defensibly attributed to Canadian investment.

Gender and climate finance

The overlap between gender and climate is extremely relevant for Canada’s current and future climate finance portfolio. Canada’s FIAP’s aggressive gender targets (95% gender-integrated, including 15% gender-principal investment by 2021-22) present a significant challenge because there is very limited overlap between gender and climate investments.

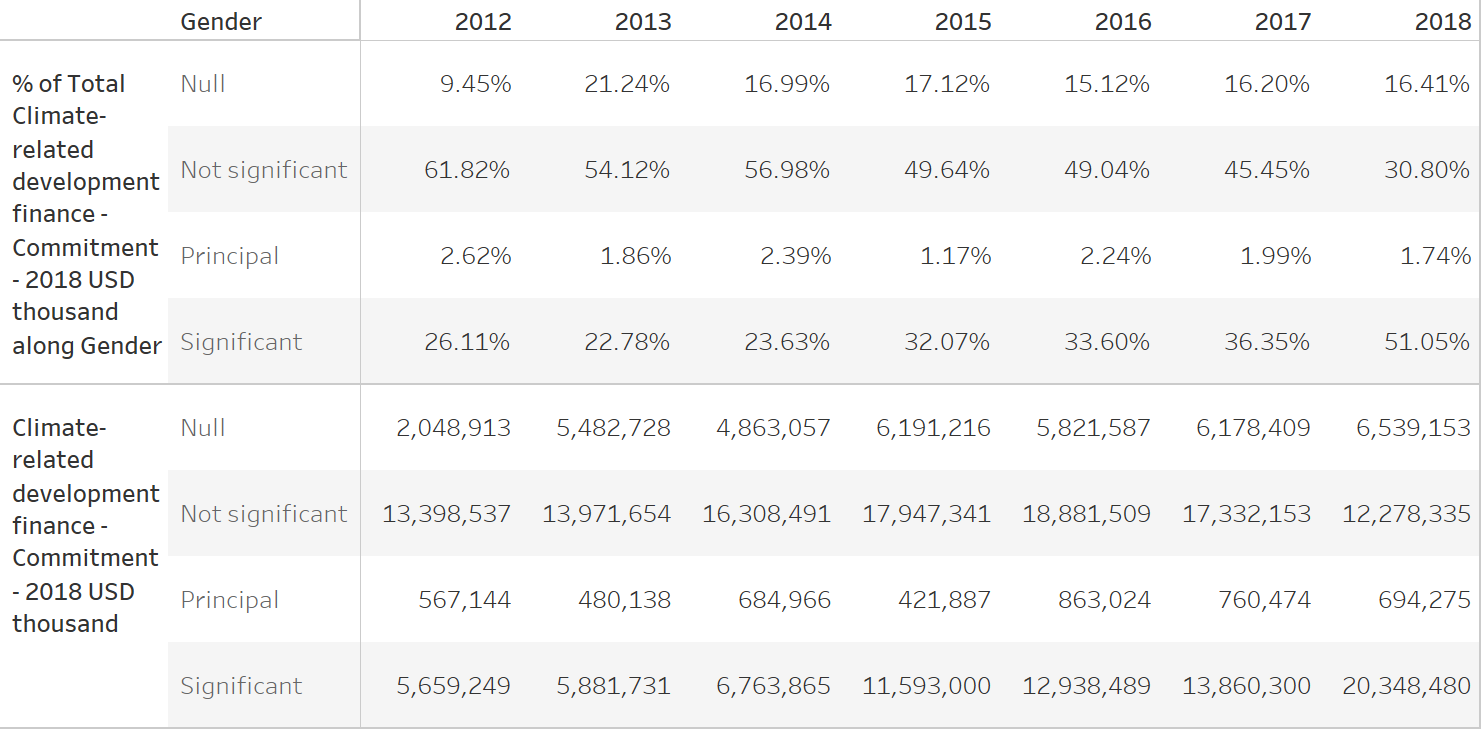

Climate investments that also qualify as gender-specific projects, between 2012 – 2018 represented only approx. 2% of overall CRDF. Approximately 60% of CRDF either does not target or is not screened for gender.

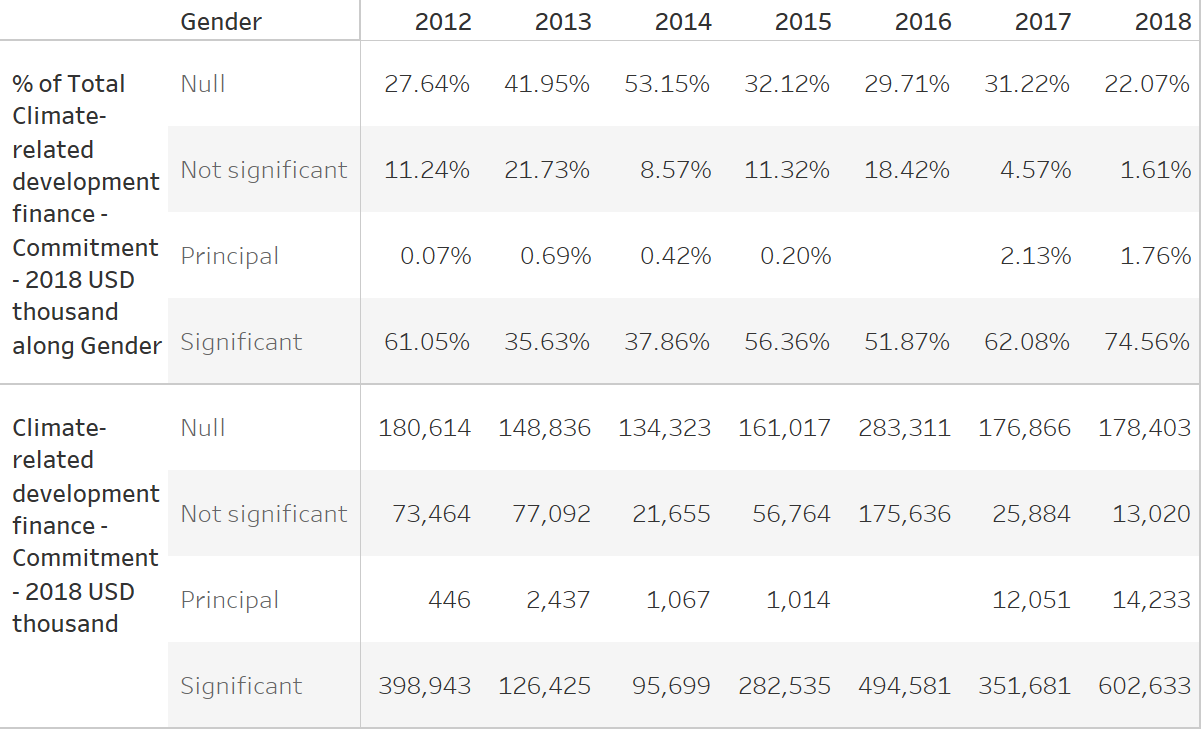

These ratios for Canada improved under the Trudeau government which brought on the FIAP at about the same time it stepped up climate finance. By 2018, approx. 76% of Canada’s climate finance at least integrated gender. However, gender-principal projects in 2018 accounted for less than 2% of Canada’s CRDF.

Increasing use of debt instruments intermediated via multilaterals arguably limits the ability to focus on gender within climate finance. At a minimum, this approach raises question regarding the coherence of Canada’s climate strategy from the perspective of the FIAP’s gender targets.

Concluding questions

This analysis raises important questions about Canada’s current and future approach to climate finance. These questions cannot be addressed by analyzing the data alone. They require nuanced discussion with decision-makers. Global Affairs Canada (GAC) is currently engaged in consultations on ‘climate finance 2.0’. This provides a great opportunity for civil society, private sector, and other stakeholders to raise these questions directly. With this in mind, we outline key areas that interlocutors should engage with GAC, Dept. of Finance and other GoC officials to first and foremost get more clarity:

- What has been the overall development impact and efficacy of Canada’s climate financing?

- What explains Canada’s shift from grants to debt-based instruments?

- What are the practical implications of this shift? As we illustrate, some of Canada’s largest individual climate investments that were previously reported as grants (2012-15) have more recently (2016-18) been reported as debt. In some cases, these are continuations or second phases. What explains the change and what is the practical import of this shift?

- Arguably part of the shift in favor of debt over grants is explained by the need to scale and demonstrate leverage. Available data indicate this has been achieved to some extent. However, what is the impact of this with regard to end outcomes?

- Additional leverage implies Canada’s share of end investments is smaller. What does this mean for attribution of results to Canadian investment, agency and influence over the direction of final investments, the net cost of leverage achieved?

- Most of Canada’s climate finance is intermediated via multilaterals. Why is this approach preferred over working more directly with recipient governments, public and private institutions in developing countries, or, via Canadian civil society and the private sector?

- Is Canada’s approach to climate finance consistent with the gender-focus of its overall development portfolio and the aggressive gender targets implied by the FIAP?

- Our analysis highlights key differences between Canada’s use of debt-based CRDF and that of other major players in this space such as Japan, Germany, France, and Korea, in terms of scope, size, scale, the targets, and objectives of debt financing. Given Canada’s indirect approach to debt provision, lack of direct involvement in the typical sub-sectors that utilize debt (e.g. large-scale infrastructure), lack of Canadian private sector involvement in implementation, relative inconsistency with gender goals, how do we make sense of Canada’s strategy?

- What are the terms, tenors, rates, and other financial characteristics of Canada’s debt based CRDF inputs? Or, what were the ex-ante financial, developmental or leverage expectations in setting up multilateral trust funds? Presumably what distinguishes loans from straight grants is that they entail some form of future re-flow either back into intermediary funds or back to Canada. Is this the case? If so, how, and where is it accounted for from a balance sheet perspective? And what if any effect may this have on future climate finance commitments?

About the data

Unless specified otherwise, this analysis is based on data from the OECD’s specific climate-related development finance (CRDF) dataset. This transformation of the OECD’s CRS data is undertaken and verified directly by the DAC’s statistical service with the aim of making climate finance more readily comparable across donors. It takes into account imputed calculations of bilateral donors’ multilateral contributions to the climate space (which other data sources do not). As such, the data are more suitable for our purposes here. Unless specified, data analyzed below is from a “provider perspective”. All data are in US$ and constant 2018 prices unless specified otherwise.

CRDF, DAC donors, 2012-18 (by climate objective)

CRDF, DAC donors, 2012-18 (by financial instrument)

Top 20 bilateral CRDF providers, 2018 (by climate objective marker)

Top 20 bilateral CRDF providers, 2018 (by financial instrument)

Top debt-based CRDF providers (by financial instrument type)

Top debt based CRDF providers, 2012-2018, total amounts

Canada’s CRDF has undergone major shifts under the Trudeau climate commitment (CRDF, principal-level only)

Canada’s top 10 principal-level CRDF investments, 2012-2018

Largest debt financed CRDF investments, 2018 (by donor, recipient, and channel type)

Canada-IFC climate change program, Final investment portfolio as of June 30,2019

Gender and CRDF, all DAC donors

Gender and CRDF, Canada

Recent Comments