by Aniket Bhushan

Published: April 23, 2019

While aid watchers and advocates will quibble about whether Canada’s aid spending is generous enough and fixate over every tenth of a decimal point of the official development assistance to gross national income (ODA/GNI) ratio, recent data show they will increasingly miss an important piece of the puzzle. Important changes are taking place under the hood of key concepts like ODA. Changes that mean it is possible to increase development spending at negligible or no fiscal cost or burden to the taxpayer. Below we explain how this works.

What are the changes under the hood of “ODA”? What are “PSIs” and what difference do they make?

Recent ODA data for 2018 are the first under a new set of rules adopted by donors and reflect changes in two main areas. The first is the move to a differentiated approach to discount rates and concessionality. While this sounds complicated, basically it means the new ‘grant equivalent’ approach rewards donors for providing more aid, on more generous terms, to poorer countries.

The second area, more important for our purpose here, has to do with private sector instruments or PSIs. Donors are now allowed to count direct equity investments, loans, guarantees, and other hybrid or blended investments, made directly to private sector companies or to intermediary institutions, provided these are development-oriented, and again on a ‘grant equivalent’ basis, as ODA. In certain cases capitalization of institutions, investment vehicles and funds also qualify as ODA.

Broadly speaking these changes reflect growing consensus among donors of the importance of engaging the private sector and crowding in private capital. On a technical level they fix important negative incentives (e.g. per the old rules, principal payments on ODA loans were counted as negative ODA and interest payments were not accounted for, under the new rules both principal and interest payments are discounted to net present value. Equity investments, while not a significant component of ODA to begin with, would have also carried a negative incentive under the old rules as the successful sale of equity in a development venture by a donor would have counted as negative ODA, under the new rules equity sale proceeds, capped at the original value of the investment, do not count as negative ODA).

The new rules are still being debated and are only provisionally agreed. The above description is a simplification, there is more nuance and complexity (e.g. there are different criteria regrading institution vs. instrument basis reporting, cash-flow vs. capitalization. Greater detail can be found here and here). However, recent data point to potential impacts on ODA. For 2018, the new grant equivalent approach adds 2.5% to ODA. The total value of development oriented PSIs is $1.5 billion (largely in the form of loans and equity investment).

How are these changes affecting Canada’s contribution and figures?

Differential discount rates don’t have a big impact on Canada for the moment as ODA loans have not been all that significant. However, given the new authorities received by GAC recently – which includes a sovereign loan program – this may change in the future. Our focus here is on a different aspect – the impact of development oriented PSIs.

In 2018 Canada launched a bilateral development finance institution (DFI), FinDev Canada. The DFI is a subsidiary of Export Development Canada (EDC). The DFI is capitalized at CAD$300mn over 5 years, and it has already done a couple of deals.

Bilateral DFIs are a type of institution whose capitalization is reportable as ODA under the new rules (because they are explicitly development-oriented, ODA-bility can be applied at the institution as opposed to instrument level).

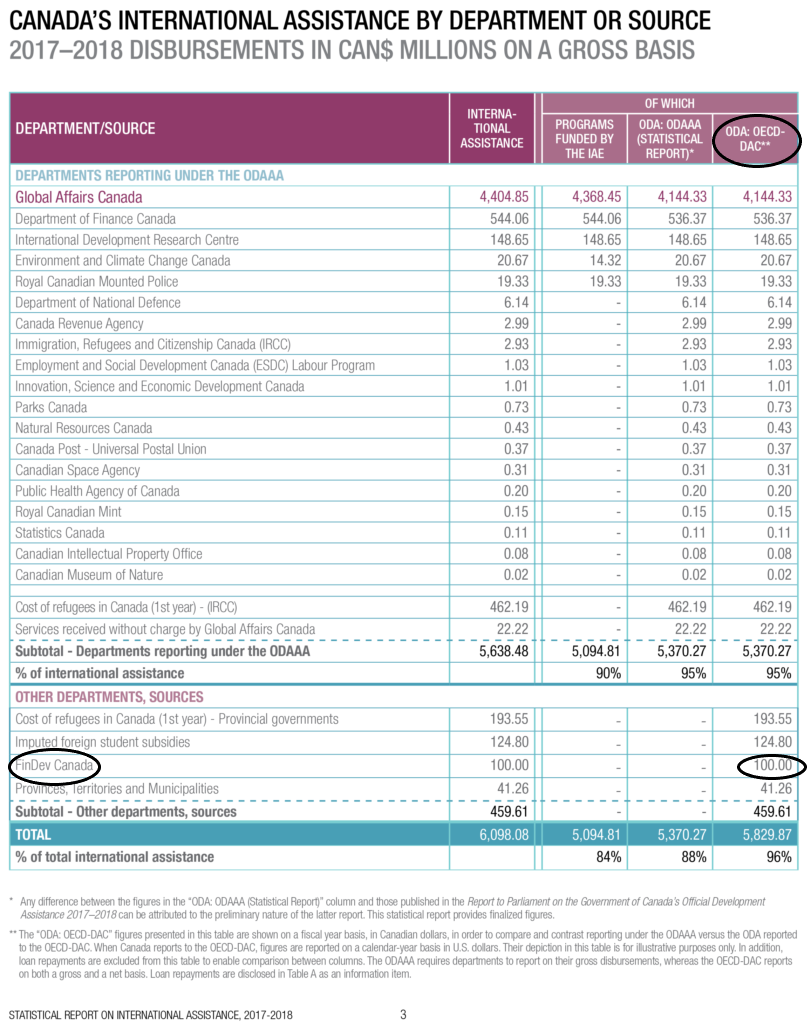

As the table below shows, in 2018, Canada reported its initial CAD$100mn capitalization of the DFI as ODA. While this is perfectly in keeping with the rules, it was one of the areas we recommended to the relevant parliamentary standing committee that should be clarified beforehand. Others have more explicitly called for the DFI to be kept separate from ODA, and initial indications were that the DFI would “complement” and therefore be separate from ODA. Nevertheless, Canada’s approach is in line with that of others (such as the UK which recently significantly recapitalized its DFI CDC Group and reported the same as ODA).

Of more interest to us here is the funding source. The main reason given for establishing the DFI within the export credit agency was efficiency (EDC already has most of the tools and authorities needed to stand up and run the institution). However another important factor is the funding source and structure.

FinDev Canada is a wholly own subsidiary of EDC. Which means its capitalization comes from EDC’s existing resources. FinDev Canada is small – relative to other bilateral DFIs it is one of the smallest but more importantly it is a mere rounding error relative to the size of its parent institution.

A brief overview of EDC and its scale helps provide perspective:

- Since its launch in 1944 EDC has facilitated over $1.4 trillion in exports and foreign investment by Canadian companies.

- Unlike other export credit agencies, which depend on annual appropriations, EDC is financially self-sufficient and operates like a traditional financial institution, with treasury and capital market operations.

- EDC is highly profitable, i.e. it makes money for the taxpayer. In 2018 EDC paid a dividend of $969mn to the government. Over the last 5 years EDC has paid approx. $4 billion in dividends to the government and therefore Canadian taxpayers.

- EDC’s total asset base is currently approx. $60 billion, and its 2019 funding program expects to raise $12 billion in debt from capital market operations.

- Like its parent, FinDev is also expected to be financially self sufficient. However its negligible size relative to its parent means it has little impact on its parent institution’s financial health. FinDev’s initial capitalization is only 0.16% of its parents asset base and less than 1% of its parent’s 2019 funding program. FinDev’s total capitalization of $300mn over 5 years represents only about 7.3% of EDC’s dividends paid to the government over the past 5 years.

- EDC’s credit rating was reaffirmed AAA stable in Jan 2019.

Increasing ODA at no fiscal cost

Canada is essentially leveraging the financial strength of its highly profitable export credit agency to increase development spending at no fiscal cost or additional burden to the taxpayer.

By launching the bilateral DFI as a small subsidiary of the much larger EDC and reporting the capitalization as ODA in keeping with new PSI rules, Canada was able to add CAD$100 mn to its 2018 ODA, increasing its OECD-DAC reportable ODA by approx. 1.7% for the year, at no additional fiscal cost. This should matter to those that view the ODA/GNI ratio as an indicator of donor fiscal effort.

Given these resources do not come out of the international assistance envelope (IAE), the main fiscal source of Canadian ODA, they are additional to the IAE, but not to future ODA (i.e. since its capitalization is recorded as ODA, future investments by FinDev, or if it further leverages its capitalization to increase investment, or reinvests future profits, would not be reportable as ODA).

However, being small and embedded in a larger parent has several advantages:

- EDC’s larger financial base and strength gives FinDev room to grow.

- If successful, there is no reason why FinDev’s capital base could not be added to if needed. Those additions could count as future ODA.

Recent Comments